Should you invest in emerging markets?

Emerging markets increase diversification, but investing in them exposes us to other risks. What are they, and how much should you tilt your portfolio?

We can’t know which country will deliver the highest returns in the future, or where the next crisis will strike hardest. For this reason, and many others, international diversification is a prudent way of reducing long-term investment risk. Rather than making predictions or picking favorites, we invest in the market as a whole.

Emerging markets make up about 12% of global equity, so including them in a portfolio is only natural. By doing so, an investor increases the number of companies, countries, and sectors that can be potential sources of return. In practice, many investors exclude them, while others give them a higher weight with allocations well above 12%. What does the scientific literature have to say on the topic?

Table of contents

- Economic growth doesn't lead to higher returns

- Emerging and developed market returns

- The problem of Skewness

- How to get exposure to emerging markets

- Conclusion

- Bibliography

Economic growth doesn't lead to higher returns

Among those that tend to overweight emerging markets in their portfolio, the justification is commonly based on the idea that these markets (China, India, Brazil, to name a few) have a very large growth potential, and that, in turn, it will translate to high future returns. The reality is actually the complete opposite. In a 2005 paper (and later updated in 2014), Jay R. Ritter demonstrated that economic growth (in terms of GDP) and the compounded real returns on equities are, in fact, inversely correlated. He showed this for 19 developed countries from 1900 to 2012 [1]. Similar results were found across 15 emerging markets, although the available data for those countries is much shorter (from 1988 to 2011). In other words, countries with strong economic growth have had lower stock market returns and, therefore, stockholders aren't necessarily the main beneficiaries of the growth. It sounded plausible in theory, but the available data shows otherwise.

Emerging and developed markets returns

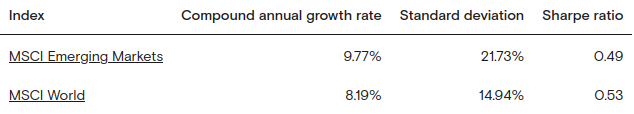

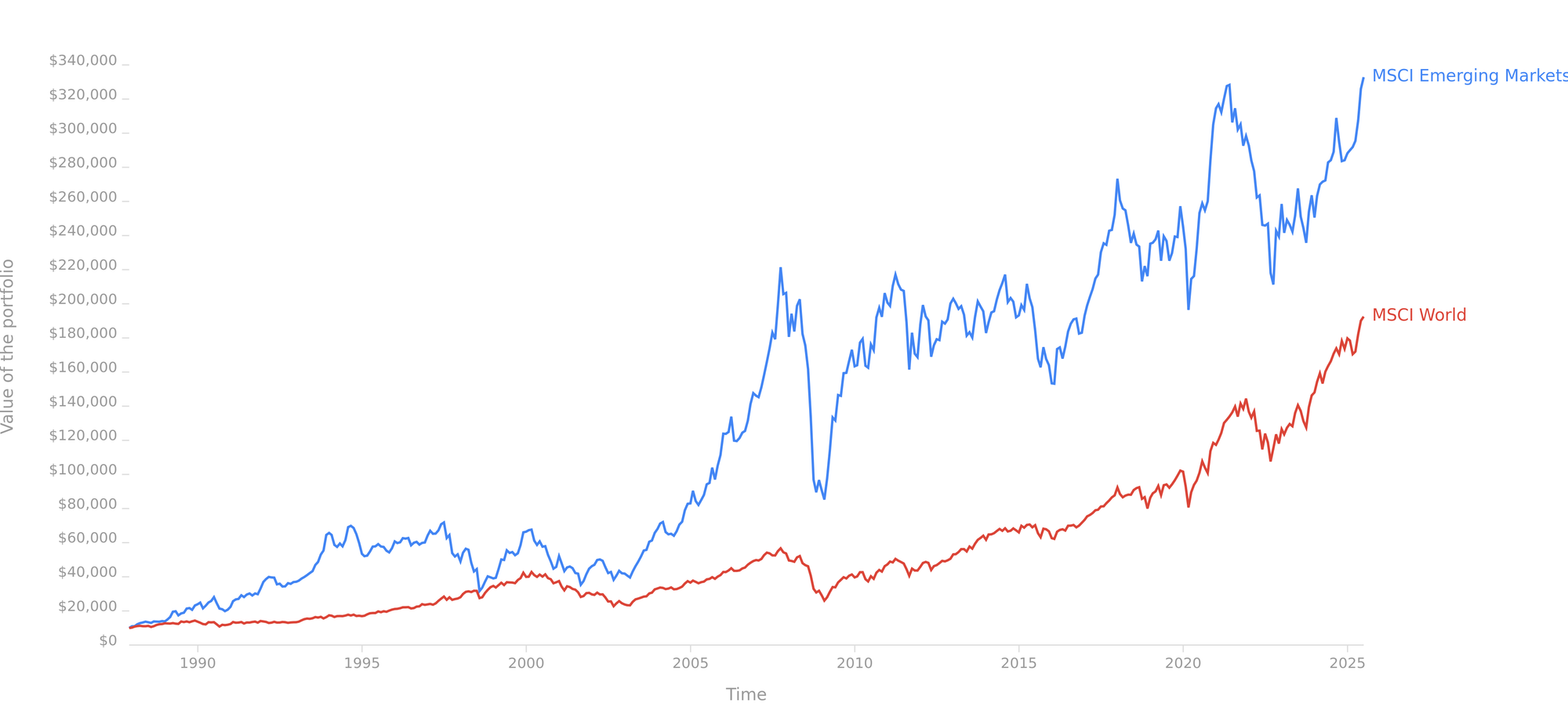

Although overweighting emerging markets might not be a sensible idea, it doesn't mean that one shouldn't invest in them at all. Over the period from 1987 to 2025, the compound annual growth rate of the MSCI Emerging Markets index returned around 1.5% more than the MSCI World index, which only includes developed markets. However, this outperformance wasn't without some bumps, as one can see the volatility is significantly higher (21.73% vs 14.94%) and therefore requires more mental fortitude to cope with the stronger variations.

1.5% might not sound like much, but as demonstrated in the previous post about the power of compounding, it can have a drastic effect. If you invested $10'000 back in 1987 in either of them, nearly 40 years later, the difference is definitely not negligeable.

The problem of skewness

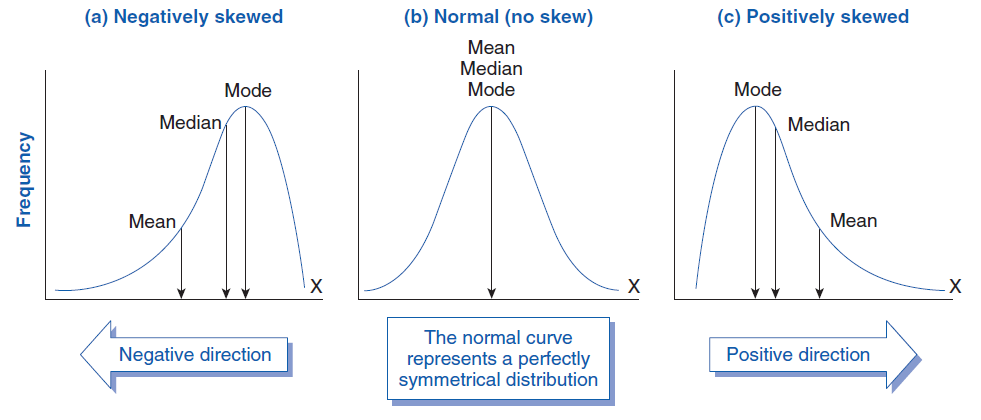

When talking about stock market returns, we often reference the average (mean) and volatility (standard deviation) over a period of time. This, however, might give the impression that the range of possible returns is symmetric and normally distributed around this mean, but it isn't. The distribution of aggregate stock market returns is asymmetric, or more precisely speaking, negatively skewed [2]. What that means is that positive returns are generally more likely to occur than negative ones (yay) but one should not forget that there is a left tail to that distribution where, although infrequent, there is nonetheless a chance of extremely negative results.

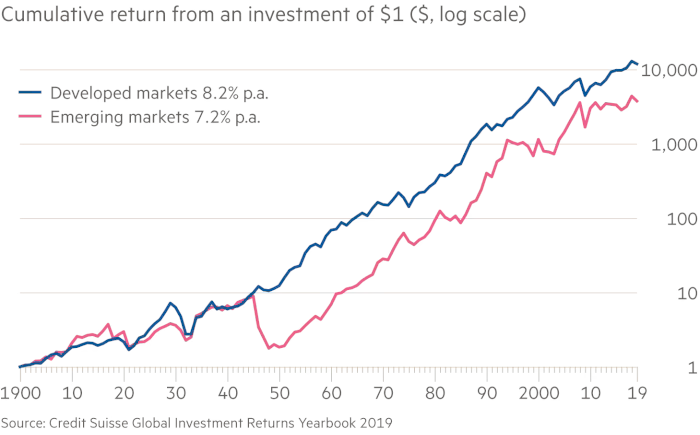

The reason this matters is that emerging markets display a more negatively skewed distribution of returns compared to developed ones, and consequently, adding them to a portfolio results in a higher risk of extreme negative results. Although in more recent history emerging markets have outperformed developed ones, if we extend the analysis over a much longer period, we discover that, in fact, emerging markets have trailed developed ones. As shown by the following plot, which represents the cumulative returns of an investment of 1$ in 1900. The slump around 1945-1949 was primarily caused by the Japanese equities plunging 98% in dollar terms after the country’s defeat in the second world war, followed by the chinese market closing off after the rise of the communist party to power.

We don't need to go that far in the past to find examples; more recently, Russia was excluded from the MSCI Emerging Markets index following the invasion of Ukraine. This brings us to why many people don't invest in emerging markets at all. Emerging markets have the reputation of being less politically stable than developed ones. Some negatives often brought up include:

- Information and transparency risk, less reliable financial reporting

- Higher risk of government seizure of assets (nationalization of companies)

- Political risk: sudden changes in government policy

- Weaker legal and institutional frameworks

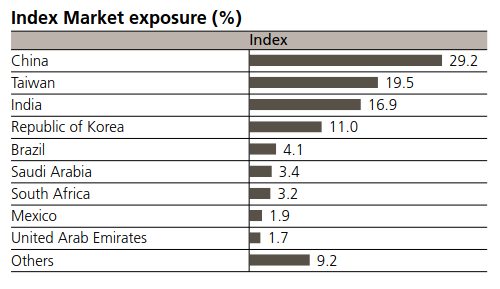

If we take a look at the current geographic exposure of the MSCI Emerging Markets index, these points aren't entirely without merit.

To be fair, however, the same could be said about some developed countries as well, especially in recent years.

How to get exposure to emerging markets

From an implementation point of view, the most straightforward way of getting exposure to both developed and emerging markets at once is the MSCI ACWI (All Country World Index). Currently, this index assigns 10.4% to emerging markets, and it's fairly easy to find ETFs that track it. If you wish to have more flexibility, you can also find ETFs that track the MSCI Emerging Markets index on its own, allowing you to define the exposure in your portfolio that you're comfortable with. Just be aware of the difference between MSCI ACWI and MSCI World, or you risk investing in emerging markets twice by mistake.

There is also a variant of this index that excludes China (MSCI Emerging Markets ex China), and ETFs that track this version are also fairly common. For as long as we have had the data for it (~25years), the performance of the two has been virtually identical.

Finally, what constitutes an emerging market is not set in stone. A notable example is South Korea, MSCI considers it an emerging market, but FTSE classifies it as developed. When building your portfolio, if you begin to mix and match multiple index providers, you could end up not including South Korea, so be aware that each agency has its own methodologies.

Conclusion

Although only representing around 12% of the global market by capitalization, emerging markets have a much wider footprint when we consider the number of people worldwide that fall in that geographic slice.

The benefits of a broader diversification can certainly reduce long-term investment risk, but the nature of emerging markets exposes an investor to other sources of uncertainty. Emerging markets are characterized by a more pronounced negative skew, making the frequency of negative events more likely to occur, including the more extreme variety. Both recent and older history reminds us that we should not disregard the chance of similar events happening in the future. So far, this higher risk has been rewarded with a higher rate of return, as one should expect, but the nature of the risk is such that you can't really protect yourself from it other than by keeping your exposure to emerging markets moderate. Personally, I wouldn't go above 10% in my own portfolio.

Bibliography

[1] Jay R. Ritter, (2005), Economic growth and equity returns, https://doi.org/10.1016/j.pacfin.2005.07.001.

[2] Rui A. Albuquerque, (2012), Skewness in Stock Returns: Reconciling the Evidence on Firm versus Aggregate Returns, https://dx.doi.org/10.2139/ssrn.1622343

Read next

Lump sum investing vs Dollar cost averaging

Lump-sum investing often outperforms dollar-cost averaging; however, DCA remains popular due to behavioral factors like loss aversion and regret.

Home-country bias

Overweighting your home country in investments may feel natural, but history shows diversification is key to managing risk and volatility.

DEGIRO review 2025

DEGIRO is a low-cost brokerage platform available to European and Swiss investors. The article takes a closer look at what it has to offer.

SwissMisfortune

SwissMisfortune