Should you currency hedge your investment?

Global diversification lowers risk but introduces currency exposure. Hedging can offset this, so should you hedge?

Global diversification is a powerful way to reduce risk when investing. By spreading the investment across many securities, the impact of any single stock's poor performance is mitigated. A broad market approach also invests in multiple sectors, and sectors tend to perform well at different points in the economic cycle, which helps balance returns. Geographical diversification makes the investment more robust against country-specific risks and performance. However, investing in multiple countries also introduces exposure to various currencies. Currencies behave differently: some may strengthen during crises, offsetting some of the losses, while periods of inflation affect them to varying degrees. This diversity can make your portfolio more resilient. You can, however, remove the currency risk with a hedge, and the natural question, then, is whether you should.

Contents

- Why investment currency matters

- Long-term foreign exchange rates

- Return comparison between hedged and unhedged

- Volatility comparison between hedged and unhedged

- Currency hedging bonds

- Currency hedging in practice

- Conclusion

- Bibliography

Why investment currency matters

To drive the point home about the issue that currency hedging tries to address, let's consider an example. You wish to invest 1000 CHF in a fund that tracks the S&P500 (the largest 500 American stocks). Currently, the exchange rate between USD/CHF is 0.80, meaning you can purchase 1000 CHF/0.8 = $1250 worth of S&P shares. After a year, your investment grows to $1500, a 20% increase. Now you wish to cash out your profits. You sell your shares and convert back your dollars to Swiss Francs, except that a year later the USD/CHF exchange rate has dropped to 0.67. You know where this is going: after converting, you end up with ~1005 CHF, essentially wiping out the gains in CHF terms, because the dollar depreciated by 20%, effectively nullifying the 20% capital gains the stocks provided.

This is obviously a manufactured example, and it should be noted that the exchange rate could've gone just as much in the other direction, meaning that the exposure to the dollar could've played in your favor, leading to a doubling of your profits in Swiss Franc terms. This is not how currency-hedged funds work, however. This example assumes you did the exchange yourself when entering and exiting the market. If you had purchased a CHF-hedged version of the S&P500 index instead, then this instrument would've returned you 20% (in CHF terms) regardless of how the two currencies varied relative to each other. The reason is that currency hedging is a continuous process.

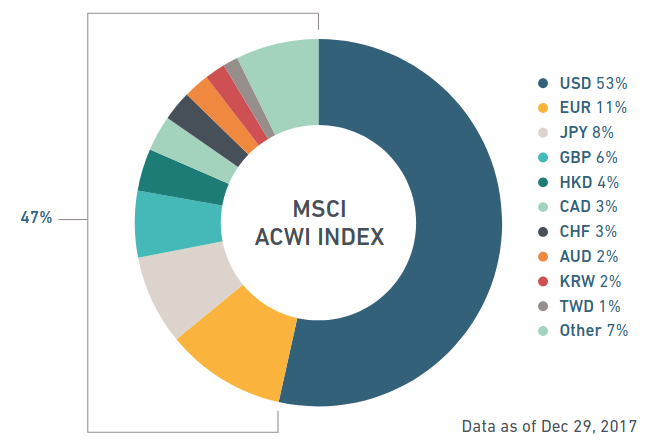

This example only considers a single currency. As a total market investor, the situation is more complex. The following image shows the currency exposure of the MSCI ACWI, which is a broad market index that includes both developed and emerging countries. Although from a few years ago, it nonetheless gives a good idea of how many currencies are at play.

Long-term foreign exchange rates

The figure below shows the exchange rates (adjusted for inflation) for 21 countries with a complete history from 1900 to 2015, relative to the US dollar. As can be seen, the exchange rate is clearly volatile; however, there is no clear long-term upward or downward trend. In short, for international investments, currency fluctuations have a more important impact in the short-term than in the long-term.

![Real exchange rates from 1900 to 2015, in US dollars, per unit of local currency (rebased to 1900 = 1). [1]](https://www.swissmisfortune.com/content/images/2025/09/dms-1.png)

In this long period, the Swiss Franc appreciated against the US dollar at an average rate of 0.76% per year; it isn't much, but it's the highest among the currencies in the dataset. The US is currently around 65% of the global market by capitalization, and the majority of the ETFs are dollar-denominated. For a Swiss investor, as for most international investors, the US dollar is the single largest currency exposure. Assuming US dominance persists in the future, and the appreciation of the Swiss Franc also continues with a slight upwards trend, then as a Swiss investor, this does indeed mean a small erosion of the returns in Swiss Franc terms, one which a currency hedge might offset. However, hedging is not without costs; currency hedged funds are typically more expensive than unhedged ones, and they often exhibit larger tracking error, meaning their performance deviates more from the index they aim to track, not capturing all the possible returns. Whether these trend assumptions hold in the future and the benefits of the hedge outweigh the costs remains debatable.

Return comparison between hedged and unhedged

Having established that currencies can have significant fluctuations in the short-term and therefore affect the returns of a broad market investment, the question is whether hedging would have improved returns.

![Comparison of hedged and unhedged returns of the MSCI ACWI Index and frequency of better returns as a function of the investment horizon, from 1970 to 2010. [2]](https://www.swissmisfortune.com/content/images/2025/09/msci_hedge-1.png)

The table shows the returns of the MSCI ACWI index in the 1979-2010 period, comparing the currency-hedged variant of the index with the unhedged one. The table also provides the statistics of how frequently the hedging outperformed with varying rolling windows. As an example, a 5-year rolling window works as follows:

- Take the first 5 years from your data (ex, 1979 to 1984).

- Compute the metric you're looking for (ex, returns of hedged vs unhedged).

- Shift the window forward by one year (1980 to 1985), then repeat.

This process allows to see how metrics evolve, smoothing short-term noise and highlighting longer-term trends.

As can be seen from the table, over the full period, hedging generally provided higher returns. However, when looking at rolling windows both for the Swiss Franc and most currencies, really, the frequency of outperformance of a hedged investment hovers around 50%. This means that whether hedging actually helps or hurts you, it boils down to a coin flip.

It should be noted that this analysis is performed at the index level. Implementing indexes as products (ETFs) that you can invest in involves transaction costs that aren't taken into consideration in this data. Likewise, implementing the currency hedge also comes with costs.

Volatility comparison between hedged and unhedged

A similar study examined portfolio risk, measured as volatility, over the period 1970 - 2010. Volatility is a measure of how much the price of your investment fluctuates over time. Across the board, currency hedging appears to have a beneficial effect on lowering volatility, especially for the Swiss Franc, which demonstrated the highest reduction. Similarly, both shorter and longer rolling windows show a consistent reduction in volatility. The behavioral implications of this shouldn't be overlooked. During periods of crisis, seeing your portfolio down 30% instead of 35% might be enough of a difference that allows you to stay invested when others pull out of the market. After all, staying invested long-term is by far the most crucial factor that will determine your success. So, if your risk tolerance isn't high, every little bit helps to stay the course during turbulent markets.

![Comparison of the volatility of hedged and unhedged variants of the MSCI ACWI Index and volatility reduction as a function of the investment horizon, from 1970 to 2009. [2]](https://www.swissmisfortune.com/content/images/2025/09/msci_vol-1.png)

Currency hedging bonds

Although much of the discussion has centered on equities, currency hedging is also important for bonds. Bonds usually have a smaller return compared to equities, but they serve an important role in reducing portfolio risk as you approach retirement. After the accumulation phase, you begin drawing down your savings, typically in your domestic currency. Because exchange rates fluctuate in the short term and bonds have lower returns, currency risk matters even more for fixed income.

Single bonds are denominated in a specific currency. As a Swiss investor, you could simply buy Swiss Government bonds or Swiss Corporate Bonds. Whether it's a single bond or you purchase a broader Swiss bond fund that contains a basket of them, the investment is typically already CHF-denominated, so currency hedging isn't needed. In practice, when you look at the interest rates either option provides (and cry a little), you'll quickly realize that as a Swiss investor, it's almost preferable to hold cash, given how low the returns are, but that's a topic for another time.

Just as there are globally diversified equity funds, there also exist globally diversified bond funds, which allow you to get a broader exposure to higher interest-paying bond funds (but also higher risk). If you go that route, however, currency hedging becomes essential, since your investment horizon is shorter and you cannot afford short-term currency fluctuations to erode your spending power.

Currency hedging in practice

From an implementation point of view, investing in currency-hedged funds isn't much different from unhedged ones. More popular ETFs usually have alternative variants that track the same index but with currency hedging applied, and the hedge is often offered in different base currencies. Popular ETF databases like justetf.com usually allow you to filter by currency hedge.

For a Swiss investor, finding CHF-hedged funds is moderately easy; typically, broad-market instruments are available. More niche and targeted funds (factor funds, thematic funds, ...) denominated in Swiss francs are still relatively uncommon.

For a quick comparison, MSCI World Index:

UBS Core MSCI World UCITS ETF USD Acc (ISIN: IE00BD4TXV59), fees: 0.06%

UBS Core MSCI World UCITS ETF hCHF Acc (ISIN: IE000N6LBS91), fees: 0.09%

Conclusion

In summary, from a returns perspective, whether to hedge your portfolio is essentially a coin toss. You're nearly as likely to profit from the hedge as to be hurt by it. As a Swiss investor, historically, the balance seems to be slightly tilted slightly in favor of hedging, but whether this tilt persists and is still significant after considering the costs associated with it is debatable.

From a behavioral perspective, currency hedging does appear to affect volatility, though not all currencies are impacted equally; but it has been remarkably effective in reducing risk in Swiss franc terms, at least in recent years. Likewise, seeing the investment grow in your own currency might feel more incentivizing and keep you invested long-term, which, at the end of the day, is what really matters.

In short, to answer the question posed by the title, the decision ultimately comes down to your personal preferences and risk tolerance.

Bibliography

[1] Dimson, E, Marsh, P and Staunton, M. Long-term asset returns. Financial Market History: reflections on the past for investors today.

[2] MSCI index reserach, 2011, Global Investing: The Importance of Currency Returns and Currency Hedging. Research Bulletin

Read next

Lump sum investing vs Dollar cost averaging

Lump-sum investing often outperforms dollar-cost averaging; however, DCA remains popular due to behavioral factors like loss aversion and regret.

Home-country bias

Overweighting your home country in investments may feel natural, but history shows diversification is key to managing risk and volatility.

DEGIRO review 2025

DEGIRO is a low-cost brokerage platform available to European and Swiss investors. The article takes a closer look at what it has to offer.

SwissMisfortune

SwissMisfortune